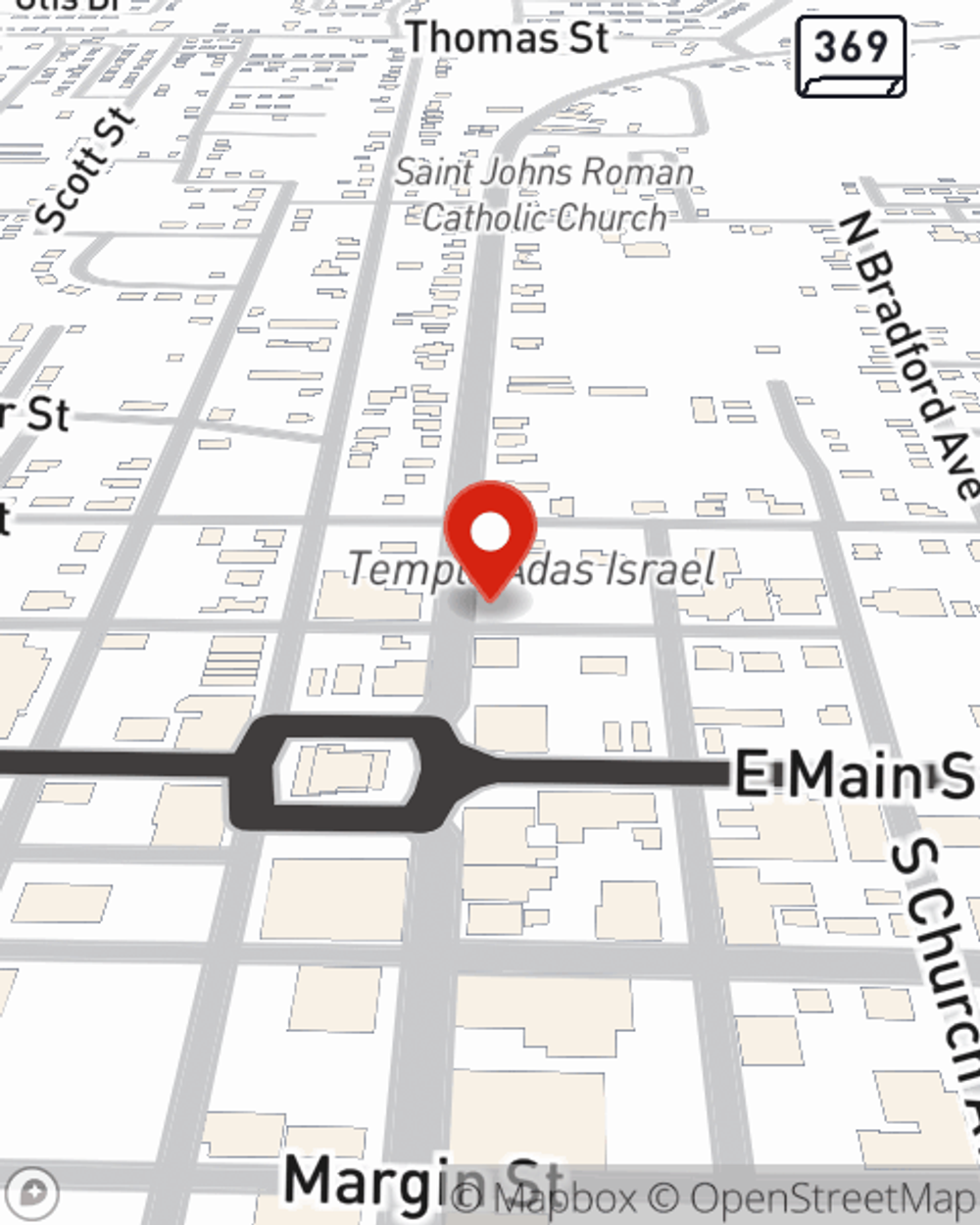

Business Insurance in and around Brownsville

Calling all small business owners of Brownsville!

Almost 100 years of helping small businesses

- Brownsville TN

- Stanton TN

- Haywood County TN

- Bells TN

- Jackson TN

- Ripley TN

- Somerville TN

- Friendship TN

Your Search For Reliable Small Business Insurance Ends Now.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected accident or loss. And you also want to care for any staff and customers who hurt themselves on your property.

Calling all small business owners of Brownsville!

Almost 100 years of helping small businesses

Strictly Business With State Farm

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like extra liability or a surety or fidelity bond, that can be created to develop a personalized policy to fit your small business's needs. And when the unexpected does happen, agent Jim McAdams can also help you file your claim.

Do what's right for your business, your employees, and your customers by contacting State Farm agent Jim McAdams today to investigate your business insurance options!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Jim McAdams

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.